11/06/2025 - 01:00 PM

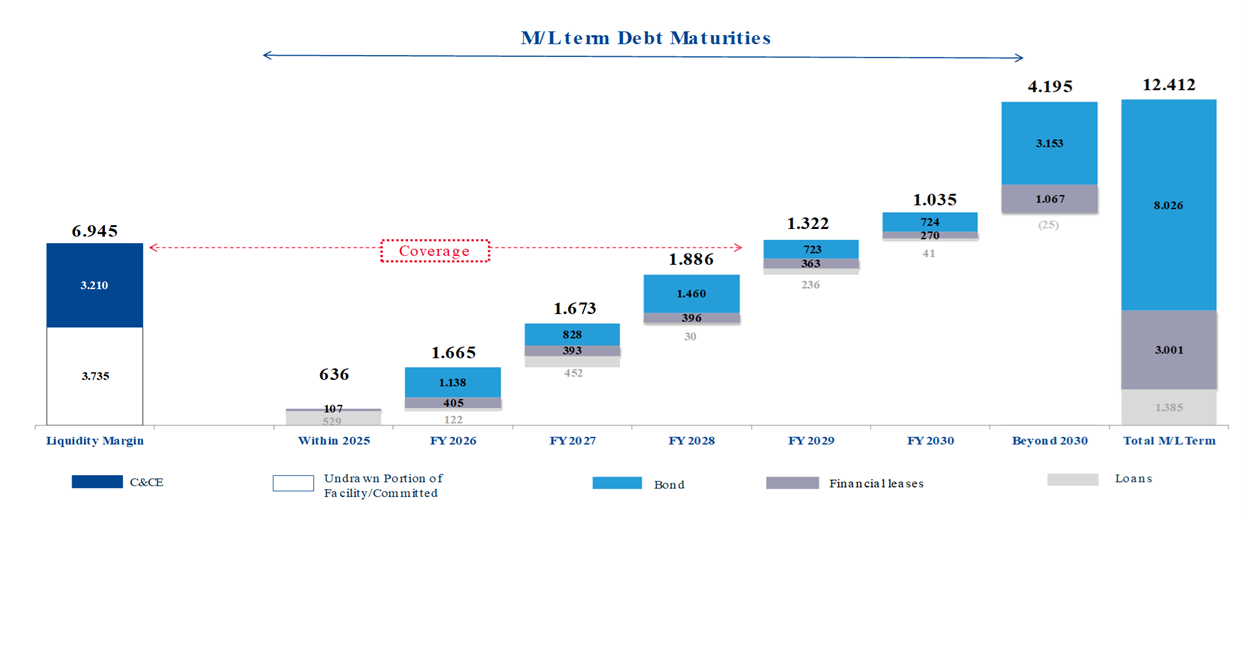

TIM Group - Medium/long term debt maturity profile as of September 30, 2025 (nominal values including IFRS16)

IIIQ 2025

Download the table

240 KB

The following table shows the available committed credit lines:

(billion euros) | 9/30/2025 | 12/31/2024 | ||

|---|---|---|---|---|

Agreed | Drawn down | Agreed | Drawn down | |

Revolving Card Facility - April 2030(*) | 3.000 | - | 4.000 | - |

Term Credit Facility - July 2030 | 0.750 | 0.015 | - | - |

Total | 3.750 | 0.015 | 4.0 | - |

(*) In accordance with the contract signed, the Banks have committed to make the funds available on demand (with at least 3 days’ notice). As this is a “Committed” line, the banks have no mechanisms in place not to honor the request for funds made by the Company, without prejudice to the market standard early mandatory cancellation clauses (Natural contract expiry, Change in control, Borrower illegality, Events of default, each as defined in the contract).

On March 31, 2025, TIM signed an agreement in order to modify the existing Revolving Credit Facility, with validity starting from April 4, 2025, extending the maturity until April 4, 2030 and reducing the amount from 4 to 3 billion euros.

On July 22, 2025, TIM entered into a new SACE-guaranteed 750 million euro Term Credit Facility with leading Italian and international banks (pursuant to Law no. 213 of December 30, 2023, as amended), currently drawn by 15 million euros.