- Revenues at € 11.4 billion over the first nine months (-0.4% YoY organic)

- Organic EBITDA: € 4.9 billion over the first nine months (-4.4% YoY)

- Net Financial Debt After Lease: € 17.6 bn (-€ 3.1 bn YoY)

- Net profit € 0.2 billion in Q3, € 0.3 billion in the first nine months excluding the impact of non-recurring items (€ 0.02 billion including the non-recurring items)

- ‘Beyond Connectivity’ plan implementation accelerating, transforming TIM into the leading operator for the digital transformation of the country:

- TIM is offering itself, together with CDP, Leonardo and Sogei, to manage the National Strategic Hub, the cloud services infrastructure for Public Administration

- FiberCop accelerates, having increased its FTTH coverage by 22% in the first nine months and brought ultrabroadband services to almost 94% of fixed lines

- TIM has been included in the new MIB®️ ESG index launched by Euronext and Borsa Italiana, the new basket dedicated to blue chip companies listed in Italy that adopt the best environmental, social, and governance (ESG) practices

- Magnifica launched, the new portfolio of tiered offers which deliver the most powerful, stable and secure connectivity ever with a dedicated customer service

- In view of the preparation of the new Strategic Plan, possible reorganization initiatives were discussed with the aim to enhance assets and company businesses’ value.

The BoD noted this favourably and invited the Chief Executive Officer to continue the analysis

TIM’s Board of Directors met today under the chairmanship of Salvatore Rossi and approved the Financial Report at September 30, 2021.

With the launch of the football offer and the enriched TimVision schedule, in the third quarter stabilization continued along with the relaunch of the domestic business and acceleration in building a new growth phase linked to adjacent markets, in particular those of content and innovative services for business customers.

Double digit growth was reported by all the group’s digital companies: Noovle, Olivetti and Telsy.

In the core business of connectivity, in a competitive context that has led several market operators to focus on prices and discounts, TIM is now setting a new pace and a significant change, launching new tariffs that aim to shift the market’s focus from competition on price to the quality of the service offered.

Net financial debt at September 30, 2021 fell by 3.3 billion euros YoY, (3.1 billion euros on an After Lease basis) to 22.2 billion euros, (17.6 billion euros on an After Lease basis).

Further significant progress was recorded in the implementation of strategic initiatives:

- National Strategic Hub: Together with Cassa Depositi e Prestiti, Leonardo and Sogei, TIM presented the public-private partnership proposal for the creation of a National Strategic Hub (NSH). Largely financed by the PNRR (national recovery and resilience plan), the project aims to provide Cloud infrastructure and services to Public Administration, pooling the distinctive skills of the partners and the best Italian and international technologies and ensuring a greater level of efficiency, safety and reliability in processing data. If awarded to the promoter and following a tender announced by the Public Administration, the initiative would involve setting up a NewCo with a stake of 20% to be held by CDP, 25% by Leonardo, 10% by Sogei and 45% by TIM. Based on this scheme, the NewCo would provide services and infrastructure to Public Administration, acquiring them mainly from its industrial partners.

- Development of the convergent offer and TimVision: in July, the new TimVision offer was launched to watch the best national and international football, together with the very best cinema and entertainment. The football offer is intended for a potential viewer base of approximately 5 million families, which until the last football championship primarily used satellite, with the aim of speeding up the switch to ultrabroadband and, accordingly, the digitization of the country. The first positive effects were already seen in the third quarter, which led to a further improvement in the growth of TIM's ultrabroadband lines and a very strong reduction in the churn rate.

- Fiber Network: the development of the FTTH network by the new company FiberCop continues, increasing the FTTH property units by 22% in 9 months, in addition to bringing broadband to almost 94% of fixed lines. An agreement was also signed in August defining Iliad's participation in the co-investment project on the FiberCop network. Iliad’s participation follows that of Fastweb and that being finalized with Tiscali, confirming the validity of the co-investment project, under review by AGCom, and of FiberCop’s plan which will ensure 75% FTTH coverage of the gray and black areas of the country by 2025. TIM will also offer Iliad access to the primary fiber network.

- Noovle: the development of the cloud and data centers business is in line with the plan targets (Q3 cloud revenues +25% YoY) thanks to Noovle’s action and the partnership with Google Cloud. A collaboration agreement was signed between TIM, Oracle and Noovle to offer multicloud services to public sector organizations and companies in Italy.

- Magnifica was launched at the end of October. It is the highest performing ultrabroadband tiered offer on the Italian market with speeds of up to 10 Gbps in download and 2 Gbps in upload thanks to TIM’s fibre. The TIM TS+ technological solution ensures a powerful, stable and secure connection in every room of the home, thanks to WiFi6 combined with certification by TIM technicians, signal optimization and the Safe Web service. Magnifica also includes dedicated assistance with priority access to the 187 customer service and TIM stores. In this first phase of testing the offer is available, for the first time in Italy, in 11 cities.

Performance in the third quarter of 2021

The stabilization of fixed service revenues continued, alongside a significant improvement in mobile service revenues. The churn rate also improved both in fixed (3.0%, after 3.4% in the second quarter and 4.0% the previous year), and in mobile where it fell to the lowest level in the last 14 years (3.6%, compared to 5.2% the previous year), reversing the typical trend of the summer season.

The total number of TIM mobile lines was 30.5 million, up on the previous quarter by 155 thousand lines. Despite the market remaining competitive in the low end (low-spending customers), the overall 'mobile number portability' figure (i.e. the flow of customers between operators) recorded a significant decrease compared to the previous year (-31% YoY), amounting to 2.3 million lines, making it the lowest third quarter of the last 10 years. Development continues in the 5G mobile network, where TIM was ranked as the fastest in Europe by Opensignal.

In fixed, thanks to the football offer and the commercial and coverage improvement actions, stabilization of the lines is confirmed and in particular there was a significant increase in ultrabroadband lines, which reached 9.7 million, including 5.1 million retail, with an increase of 652,000 lines in the first 9 months (1,050,000 lines including wholesale).

Group revenues in the quarter amounted to 3.8 billion euros (-2.1% YoY), while revenues from services amounted to 3.5 billion euros, with an improving trend compared to the previous year (-1.4% versus -1.7% YoY).

The growth in revenues related to innovative "beyond connectivity" services continues, with the cloud showing a record increase (+ 25% YoY in the quarter) and total ICT revenues up 13.3% despite some projects being postponed to the fourth quarter.

In Wholesale (international and domestic) fixed service revenues in Q3 2021 grew by 1.4% YoY.

In Brazil, service revenues grew (+4.2% YoY), benefiting from the strategy focused on value that has brought about a significant increase in average revenues per user (ARPU).

The Group’s organic EBITDA in the quarter was 1.7 billion euros (-5.9% YoY), that of the Domestic Business Unit 1.3 billion euros (-8,3% YoY) and that of TIM Brasil 0.3 billion euros (+4.4% YoY). These figures were affected by start-up costs in adjacent markets and a comparison with the third quarter of 2020, which benefited from a series of cost savings linked to COVID-19.

Group After Lease EBITDA was 1.5 billion euros (-7.6% YoY): 1.2 billion euros at domestic level (-9.2% YoY).

At Group level, investments were 0.9 billion euros, in line with the plan’s objectives and with an increasing trend (+21% YoY excluding licenses) linked both to the slowdown attributable to COVID-19 in the third quarter of 2020, and to investments having been brought forward from the fourth quarter of 2021. The mix of investments has changed and is now mainly dedicated to growth both in Italy (fiber networks, cloud & data centers, partnership with DAZN) and Brazil.

The net profit attributable to the Owners of the Parent Company stood at 0.2 billion euros in the quarter.

Organic results (1)

(million euros) | 3rd Quarter 2021 | 3rd Quarter 2020 | % Change | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | % Change |

|---|

| (a) | comparable

(b) | | (a) | comparable

(b) | |

|---|

TOTAL REVENUES | 3,836 | 3,918 | (2.1) | 11,403 | 11,449 | (0.4) |

Domestic | 3,111 | 3,214 | (3.2) | 9,344 | 9,498 | (1.6) |

Brazil | 731 | 710 | 2.8 | 2,079 | 1,974 | 5.3 |

Other activities, adjustments and eliminations | (6) | (6) | — | (20) | (23) | — |

SERVICE REVENUES | 3,484 | 3,532 | (1.4) | 10,330 | 10,528 | (1.9) |

Domestic | 2,780 | 2,856 | (2.7) | 8,331 | 8,634 | (3.5) |

o/w Wireline | 2,090 | 2,145 | (2.5) | 6,385 | 6,502 | (1.8) |

o/w Mobile | 821 | 846 | (3.0) | 2,361 | 2,543 | (7.2) |

Brazil | 710 | 682 | 4.2 | 2,019 | 1,917 | 5.3 |

Other activities, adjustments and eliminations | (6) | (6) | — | (20) | (23) | — |

EBITDA | 1,669 | 1,773 | (5.9) | 4,886 | 5,112 | (4.4) |

Domestic | 1,322 | 1,441 | (8.3) | 3,913 | 4,186 | (6.5) |

Brazil | 348 | 334 | 4.4 | 980 | 932 | 5.2 |

Other activities, adjustments and eliminations | (1) | (2) | — | (7) | (6) | — |

EBITDA After Lease | 1,462 | 1,581 | (7.6) | 4,278 | 4,535 | (5.7) |

Domestic | 1,196 | 1,317 | (9.2) | 3,532 | 3,809 | (7.3) |

Brazil | 267 | 267 | — | 753 | 732 | 2.9 |

Other activities, adjustments and eliminations | (1) | (3) | — | (7) | (6) | — |

CAPEX (net of TLC licenses) | 912 | 755 | 20.8 | 2,480 | 1,955 | 26.9 |

Domestic | 765 | 617 | 24.0 | 1,990 | 1,574 | 26.4 |

Brazil | 147 | 138 | 5.4 | 490 | 381 | 28.8 |

(1) The organic results exclude non-recurring items and the comparable base is calculated net of the foreign currency translation and the change in the scope of consolidation.

(million euros) | 3rd Quarter 2021 | 3rd Quarter 2020 | % Change | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | % Change |

|---|

| (a) | (b) | | (a) | (b) | |

|---|

Equity Free Cash Flow | 97 | 688 | (85.9) | 460 | 1,666 | (72.4) |

Equity Free Cash Flow After Lease | (61) | 462 | — | 28 | 993 | (97.2) |

Adjusted Net Financial Debt (2) | | | | 22,164 | 25,469 | (13.0) |

Net Financial Debt After Lease(2) | | | | 17,613 | 20,741 | (15.1) |

(1) Adjusted net financial debt. The change in the fair value of derivatives and related financial liabilities/assets is adjusted by the booked Net Financial Debt with no monetary effect.

Last July the Group reflected in its guidance the inclusion of startup costs of football and the delays in the introduction of voucher programs. 2021 FY forecast, based on 30 September actuals, taking into account startup costs, capex and deteriorating domestic market conditions, brought to guidance revision, as illustrated on page 18.

TIM’S INITIATIVES FOR THE DIGITIZATION OF THE COUNTRY AND SUPPORT FOLLOWING THE COVID-19 EMERGENCY

TIM moves forward with its country-wide digitization plan with the goal of effectively responding to the needs that have emerged with the COVID-19 pandemic, pursuing initiatives to support citizens, companies and institutions. The main actions that were pursued during the first nine months of this year are set out below.

Fiber coverage interventions

- From January to September 2021, 5,880 cabinets were implemented taking the total number of municipalities that have benefited from fiber coverage interventions since March 2020 to approximately 4,200.

School and digital skills

- The work of the “Operazione Risorgimento Digitale” also continues, this great alliance promoted by TIM and more than 40 excellent partners in the public, private and non-profit sector, to reduce the digital divide and overcome the gap in respect of other European countries in the use of new technologies. To date, more than 60,000 people have been trained, 60,000 requests for support in using technology handled and awareness-raising initiatives carried out that have involved more than 1 million people.

- Launched on September 30, the KidsVille project, in a partnership with Junior Achievement Italia, is a citizen education program also aiming to develop life skills, intended for children from nursery school through to primary and for parents and teachers. The route focuses on three areas: life in the community, environmental sustainability and the digital world.

Customers

- E-learning card continues, the offer available to all prepaid TIM mobile telephony customers that allows them to browse the main e-learning platforms, without limits or costs. In all, 240,387 e-learning cards were activated between May 15, 2020 (when the initiative was launched) and September 30, 2021, and 48,957 new registrations during the period January-September 2021.

Employees

- The screening campaign continues for the prevention of COVID-19 infection, through the running of blood and rapid antigen tests for all TIM employees, with the collaboration of Assilt.

- Specific procedures have been drawn up for handling any cases of ascertained or suspected positivity to COVID-19, as well as specific insurance cover for employees in the event of hospitalization following contagion.

- Smart working continues for more than 33,000 employees at September 30, 2021. Activities have been planned for the completely safe return to the office, including through specific agreements stipulated with Trade Unions.

TIM Brasil (selection of main initiatives)

- 76% of employees, including call center workers, have been assigned to work from home. The program has proved to be a winning one and will continue to operate in this way even after the pandemic ends.

- Monitoring and statistical control by the Health and Safety Department of ascertained cases of COVID-19 amongst employees and third parties allocated to TIM proprietary stores.

- Extension of the validity of credits up to 20 reais for 60 days in support of low-income prepaid customers.

- Access to the SUS health system Coronavirus application and the Ministry of Health website without consuming Internet data.

- The first operator in Brazil to establish a technological partnership in support of the fight against COVID-19 for the application of aggregated anonymous data analysis.

- The company has made the needs of corporate subscribers of the government area a priority, seeking to guarantee the greatest possible level of resource availability, in particular for health institutions and hospitals.

- Partnerships between Brazilian operators to create an Internet plan at reduced costs for governments (federal, state and municipal), with the aim of offering free Internet access to public school students on e-learning platforms.

- Participation in the Salvando Vidas match-funding campaign of Banca Nazionale per lo Sviluppo Economico e Sociale (BNDES), with the donation of 500,000 reais for the purchase of medical and hospital materials, equipment and other supplies necessary in the fight against COVID-19.

- Instituto TIM has renewed its support of the Gesto Solidário, campaign promoted by Instituto Biomob, for another six months, donating more than 1,700 basic food baskets to 600 families in socially vulnerable positions in the various communities of the state of Rio de Janeiro.

- Structured learning initiatives continue for employees with contents on topics linked to the pandemic, such as remote working practices, mental health and well-being and protocols of conduct.

- The home delivery services of work tools and benefit products continues, eliminating the need to physically enter the TIM offices. Access to the health plan has migrated 100% to digital cards.

- Work continues on mapping employees and family members in high risk groups and carrying out COVID-19 tests, particularly in stores.

NON-FINANCIAL PERFORMANCE

During the first nine months of the year, the social commitments, included in the 2021-2023 Strategic Plan, were strengthened with the initiatives carried out to digitize the country and counter the COVID-19 emergency that affected Italy and all the other countries in which we operate. Today more than ever, TIM's infrastructure and the work of its people have been confirmed as fundamental to speed up achievement of the objectives of the 2030 Agenda.

At the beginning of January 2021, the Group aligned its funding sources with the Strategic Plan which places ESG objectives at the center of its development strategy, very successfully placing TIM's first Sustainability Bond for a billion euros. During the period, TIM maintained its presence on the main sustainability indexes and ratings.

Sustainability governance was also further strengthened by setting up a Board Sustainability Committee chaired by the Chairman of the TIM Group and assigned the task, amongst others, of speeding up implementation of environmental, social and governance (ESG) commitments, included in the Strategic Plan.

The third quarter 2021 results will be presented to the financial community during the webcast and audio conference on October 28, 2021. The event will start at 2.00 p.m. (Italian time). The presentation will be followed by a Q&A session. Journalists may listen in to the presentation via phone and online, without asking questions, by calling +39 06 33444 and following the instructions for assisted conferences or by connecting to the following link . The presentation slides will be available at link .

TIM voluntarily writes and publishes periodic financial information referring to the first and third quarter of each year as part of its corporate policy on regular financial and operating performance disclosure addressed to the market and to investors, in line with the best market practices.

The consolidated figures of the TIM Group presented in this periodic financial information at September 30, 2021 have been prepared in compliance with the International Financial Reporting Standards issued by the IASB and endorsed by the EU; such figures are unaudited.

The accounting policies and consolidation principles adopted are consistent with those applied for the TIM Group Consolidated Financial Statements at December 31, 2020, to which reference should be made, except for the changes to the accounting standards issued by the IASB and in force as of January 1, 2021.

TIM Group, in addition to the conventional financial performance measures established by the IFRS, uses certain alternative performance measures in order to present a better understanding of the trend of operations and financial condition. Specifically, these alternative performance measures refer to: EBITDA; EBIT; organic change and impact of non-recurring items on revenues, EBITDA and EBIT; EBITDA margin and EBIT margin; and net financial debt carrying amount and adjusted net financial debt; Equity Free Cash Flow. Following the adoption of IFRS 16, the TIM Group also presents the following additional alternative performance measures:

- EBITDA adjusted After Lease (“EBITDA-AL”), calculated by adjusting the Organic EBITDA, net of the non-recurring items, from the amounts connected with the accounting treatment of lease contracts according to IFRS 16;

- Adjusted net financial debt After Lease, calculated by excluding from the adjusted net financial debt the liabilities related to the accounting treatment of lease contracts according to IFRS 16;

- Equity Free Cash Flow After Lease, calculated by excluding from the Equity Free Cash Flow the amounts related to lease payments.

In line with the ESMA guidance on alternative performance measures (Guidelines ESMA/2015/1415), the meaning and contents of such are explained in the annex and the analytical detail of the amounts of the reclassifications introduced and of the methods for determining indicators is also provided.

Lastly, the section entitled "Business Outlook for the year 2021" contains forward-looking statements in relation to the Group's intentions, beliefs or current expectations regarding financial performance and other aspects of the Group's operations and strategies. Readers are reminded not to place undue reliance on forward-looking statements; in fact, actual results may differ significantly from forecasts owing to risks and uncertainties depending on numerous factors, the majority of which are beyond the scope of the Group’s control. Please refer to the chapter "Main risks and uncertainties" and the contents of the Annual Financial Report at December 31, 2020 for more information. It provides a detailed description of the major risks pertaining to the TIM Group business activity which can, even considerably, affect its ability to meet the set goals.

MAIN CHANGES IN THE SCOPE OF CONSOLIDATION OF THE TIM GROUP

The following were the main corporate transactions implemented during the first nine months of 2021:

- Noovle S.p.A. (Domestic Business Unit): starting January 1, 2021, the conferral is effective to Noovle S.p.A. of the TIM S.p.A. business unit comprising the assets and liabilities and employees involved in the supply of services for the Cloud and Edge Computing and the rent of spaces, including virtual, also offered through a dedicated network of data centers;

- FiberCop S.p.A.; Flash Fiber S.r.l. (Business Unit Domestic): starting March 31, 2021, the conferral is effective to FiberCop S.p.A. of the TIM S.p.A. business unit comprising the goods, assets and liabilities and legal relations organized functionally for the supply of passive fiber or copper access services, used by TIM, and at the service of other authorized operators (OAOs), by means of the secondary network (the “last mile”). At the same time, the purchase was completed by Teemo Bidco, an indirect subsidiary of KKR Global Infrastructure Investors III L.P., of 37.5% of FiberCop from TIM and Fastweb has subscribed FiberCop shares corresponding to 4.5% of the company’s capital, through the conferral of the stake held in Flash Fiber, which was simultaneously incorporated into FiberCop;

- TIM Tank S.r.l. (Other activities): on April 1, 2021, it was merged into Telecom Italia Ventures S.r.l. with accounting and tax effects backdated to January 1, 2021;

- Telecom Italia Trust Technologies S.r.l. (Business Unit Domestic): starting April 1, 2021, the investment in the company was conferred by TIM S.p.A. to Olivetti S.p.A.;

- TIM S.p.A. (Domestic Business Unit): on June 30, 2021, the purchase of the BT Italia Business Unit was completed, offering services to public administration customers and small and medium business/enterprise (SMB/SME) customers. The purchase also includes support for customers of the SMB Business Unit, supplied by Atlanet, the BT Contact Center of Palermo;

- TIM Servizi Digitali S.p.A. (Domestic Business Unit): company established on July 30, 2021; the company’s corporate purpose is the development and maintenance of plants for the supply of telecommunications services; to this end, we note that in September 2021, the company stipulated a rental contract with Sittel S.p.A. for a business unit consisting of the “construction”, “delivery” and “assurance” of telecommunications networks and plants;

- Panama Digital Gateway S.A. (Domestic Business Unit): company established in July 2021 for the construction of a digital hub that seeks to offer a reference hub for the whole of Central America, the region of the Andes and the Caribbean;

- Staer Sistemi S.r.l. (Domestic Business Unit): company acquired by Olivetti S.p.A. on September 30, 2021. The company’s corporate purpose is the carrying out of activities connected with the production and marketing of electronic systems and programs and activities connected with energy efficiency plants.

The following should also be noted:

- TIMFin S.p.A.: on January 14, 2021, it was registered with the Register of Financial Intermediaries pursuant to Art. 106 of the CLB.

During the first nine months of 2020, the main changes in the scope of consolidation were as follows:

- Infrastrutture Wireless Italiane S.p.A. (INWIT) (Domestic Business Unit): on March 31, 2020 the merger by incorporation of Vodafone Towers S.r.l. into INWIT S.p.A. was completed. The transaction, which enabled the creation of Italy's leading tower operator, entailed the dilution of the TIM Group's stake in the capital of INWIT from 60% to 37.5%; therefore, as of March 31, 2020, the equity investment in INWIT S.p.A. is accounted for using the equity method. Starting from the Consolidated Financial Statements as at December 31, 2019 and until the completion of the aforementioned merger INWIT S.p.A. was presented as an "Asset held for sale"; therefore, TIM Group consolidated economic data and cash flows for the first nine months of 2020 include data of INWIT S.p.a. for the first quarter of 2020, net of amortization and depreciation for the period, as required by IFRS 5. Also note that during FY 2020, additional stock packets were transferred, corresponding to 7.3% of INWIT share capital. At September 30, 2021, TIM Group’s investment held in INWIT was 30.2%;

- Noovle S.r.l. (Domestic Business Unit): on May 21, 2020, TIM S.p.A. finalized the acquisition of 100% of the quotas in Noovle S.r.l., an Italian ICT consulting and system integration company, specialized in supplying cloud solutions and projects and one of Google Cloud's leading partners on the Italian market;

- Daphne 3 S.p.A. (Domestic Business Unit): company established on July 24, 2020; the corporate purpose is the acquisition, holding, management and disposal of equity investments in INWIT - Infrastrutture Wireless Italiane S.p.A.;

- TIM My Broker S.r.l. (Domestic Business Unit): company established on August 4, 2020; the corporate purpose is mainly insurance intermediation activities pursuant to art. 106 of Legislative Decree no. 209 of September 7, 2005 as subsequently amended and supplemented.

The following should also be noted:

- TIM Participações S.A. (Brazil Business Unit): merger by incorporation into TIM S.A. became effective as of September 2020;

- TN Fiber S.r.l. (Business Unit Domestic): was merged into TIM S.p.A. on September 30, 2020, with tax effects backdated to January 1, 2020;

- TIMFin S.p.A.: on November 3, 2020, the Bank of Italy authorized TIMFin to carry out the business of granting loans to the public pursuant to articles 106 et seq. of the CLB. Registration in the Register of Financial Intermediaries is subject to the fulfillment of certain operational requirements.

TIM GROUP RESULTS FOR THE FIRST NINE MONTHS OF 2021

Total TIM Group revenues for the first nine months of 2021 amounted to 11,403 million euros, -2.2% compared to the first nine months of 2020 (11,657 million euros), in organic terms -0.4%.

The breakdown of total revenues for the first nine months of 2021, by operating segment in comparison with the first nine months of 2020 is as follows:

(million euros) | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | Changes |

|---|

| | % weight | | % weight | absolute | % | % organic excluding non-recurring |

|---|

Domestic | 9,344 | 81.9 | 9,472 | 81.3 | (128) | (1.4) | (1.6) |

Brazil | 2,079 | 18.2 | 2,208 | 18.9 | (129) | (5.8) | 5.3 |

Other Operations | — | — | — | — | — | | |

Adjustments and eliminations | (20) | (0.1) | (23) | (0.2) | 3 | | |

Consolidated Total | 11,403 | 100.0 | 11,657 | 100.0 | (254) | (2.2) | (0.4) |

The organic change in the Group’s consolidated revenues is calculated by excluding the negative effect of exchange rate changes[1] (-243 million euros), the changes in the scope of consolidation (INWIT) (-3 million euros) as well as non-recurring items. In particular, the first nine months of 2020 was affected by adjustments of non-recurring revenues for -38 million euros, connected with the commercial initiatives of TIM S.p.A. to support customers in dealing with the COVID-19 emergencies.

Revenues for the third quarter of 2021 totaled 3,836 million euros (3,898 million euros in the third quarter of 2020).

TIM Group EBITDA for the first nine months of 2021 was 4,394 million euros (5,118 million euros in the first nine months of 2020, -4.4% in organic terms).

The breakdown of EBITDA and the EBITDA margin broken down by operating segment for the first nine months of 2021 compared with the first nine months of 2020, are as follows:

(million euros) | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | Changes |

|---|

| | % weight | | % weight | absolute | % | % organic excluding non-recurring |

|---|

Domestic | 3,424 | 77.9 | 4,081 | 79.7 | (657) | (16.1) | (6.5) |

% of Revenues | 36.6 | | 43.1 | | | (6.5) pp | (2.2) pp |

Brazil | 977 | 22.2 | 1,043 | 20.4 | (66) | (6.3) | 5.2 |

% of Revenues | 47.0 | | 47.2 | | | (0.2) pp | 0,0pp |

Other Operations | (6) | (0.1) | (7) | (0.1) | 1 | | |

Adjustments and eliminations | (1) | — | 1 | — | (2) | | |

Consolidated Total | 4,394 | 100.0 | 5,118 | 100.0 | (724) | (14.1) | (4.4) |

Organic EBITDA - net of the non-recurring items amounted to 4,886 million euros; the EBITDA margin was 42.8% (5,112 million euros in the first nine months of 2020, with an EBITDA margin of 44.7%).

EBITDA for the first nine months of 2021, which includes an improvement of deferred contract costs linked to the reduction of churn, suffered net non-recurring charges for a total of 492 million euros mainly relating to employee benefits expenses, also connected with the application of Art. 4 of Italian Law 92 of June 28, 2012, as defined by the Trade Union Agreements signed by various Group companies, including the Parent Company TIM S.p.A. and the Trade Union Organizations. Non-recurring charges also include provisions for disputes, transactions, regulatory sanctions and potential liabilities related to them, as well as expenses connected with agreements and the development of non-recurring projects as well as expenses connected with the COVID-19 emergency (20 million euros), mainly for provisions made for credit management of some customers.

In the first nine months of 2020, the TIM Group recorded net non-recurring charges for a total of 176 million euros (net of the change in scope for 5 million euros), of which 89 million euros were attributable to the COVID-19 emergency in Italy. The first nine months of 2020 also suffered non-recurring charges connected mainly with

corporate reorganization/restructuring processes and provisions for disputes, regulatory sanctions and potential liabilities and expenses connected with agreements and the development of non-recurring projects.

Organic EBITDA, net of the non-recurring component, is calculated as follows:

[1] The average exchange rates used for the translation into euro (expressed in terms of units of local currency per 1 euro) were 6.37804 for the Brazilian real in the first nine months of 2021 and 5.70299 in the first nine months of 2020; for the US dollar, the average exchange rates used were 1.19616 in the first nine months of 2021 and 1.12444 in the first nine months of 2020. The effect of the change in exchange rates is calculated by applying the foreign currency translation rates used for the current period to the period under comparison.

(million euros) | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | Changes |

|---|

| | | absolute | % |

|---|

EBITDA | 4,394 | 5,118 | (724) | (14.1) |

Foreign currency financial statements translation effect | | (113) | 113 | |

Changes in the scope of consolidation | | (69) | 69 | |

Non-recurring expenses/(income) | 492 | 176 | 316 | |

ORGANIC EBITDA - excluding non-recurring items | 4,886 | 5,112 | (226) | (4.4) |

% of Revenues | 42.8 | 44.7 | | (1.9) pp |

The EBITDA of the third quarter of 2021 totaled 1,624 million euros (1,720 million euros in the third quarter of 2020).

Organic EBITDA net of the non-recurring component in the third quarter of 2021 totaled 1,669 million euros (1,773 million euros in the third quarter of 2020).

TIM Group EBIT for the first nine months of 2021 was 985 million euros (1,627 million euros in the first nine months of 2020).

Organic EBIT, net of the non-recurring component, amounted to 1,477 million euros (1,696 million euros for the first nine months of 2020), with an EBIT margin of 13.0% (14.8% for the first nine months of 2020).

Organic EBIT, net of the non-recurring component, is calculated as follows:

(million euros) | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | Changes |

|---|

| | | absolute | % |

|---|

EBIT | 985 | 1,627 | (642) | (39.5) |

Foreign currency financial statements translation effect | | (34) | 34 | |

Changes in the scope of consolidation | | (73) | 73 | |

Non-recurring expenses/(income) | 492 | 176 | 316 | |

ORGANIC EBIT - excluding non-recurring items | 1,477 | 1,696 | (219) | (12.9) |

Exchange rate fluctuations mainly related to the Brazil Business Unit.

The EBIT of the third quarter of 2021 totaled 484 million euros (585 million euros in the third quarter of 2020).

Organic EBIT net of the non-recurring component in the third quarter of 2021 totaled 529 million euros (631 million euros in the third quarter of 2020).

Net profit attributable to Owners of the Parent for the first nine months of 2021, was 22 million euros (1,178 million euros in the first nine months of 2020); excluding the impact of non-recurring items, the net profit for the first nine months of 2021 was 342 million euros (870 million euros in the first nine months of 2020).

The TIM Group headcount at September 30, 2021 was 52,190 units, of which 42,565 in Italy (52,347 at December 31, 2020, of which 42,680 in Italy), with a decrease of 157 compared to December 31, 2020 (in Italy -115). Compared to September 30, 2020 the reduction was 290.

Capital expenditures and expenses for mobile telephone licenses/spectrum for the first nine months of 2021, were 2,720 million euros (2,006 million euros in the first nine months of 2020).

Capex is broken down as follows by operating segment:

(million euros) | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | Change |

|---|

| | % weight | | % weight | |

|---|

Domestic | 2,230 | 82.0 | 1,580 | 78.8 | 650 |

Brazil | 490 | 18.0 | 426 | 21.2 | 64 |

Other Operations | — | — | — | — | — |

Adjustments and eliminations | — | — | — | — | — |

Consolidated Total | 2,720 | 100.0 | 2,006 | 100.0 | 714 |

% of Revenues | 23.9 | | 17.2 | | 6,7pp |

In particular:

- the Domestic Business Unit records capital expenditure for 2,230 million euros, +650 million euros on the first nine months of 2020, an increase mainly due to the development of the FTTC/FTTH networks and payment of licenses (240 million euros) to the Italian Ministry of Economic Development (MISE) for the extension of rights of use relative to frequencies (2100 MHz);

- the Brazil Business Unit posted capital expenditures in the first nine months of 2021 of 490 million euros (426 million euros for the first nine months of 2020). Excluding the impact of changes in exchange rates (-45 million euros), capex grew by 109 million euros, mainly to strengthen the mobile UltraBroadBand infrastructure and the development of the fixed broadband business of TIM Live.

The Group’s operating free cash flow for the first nine months of 2021 is positive for 1,083 million euros (2,374 million euros in the first nine months of 2020), i.e. 1,378 million euros (2,484 million euros in the first nine months of 2020), net of 295 million euros (110 million euros in the first nine months of 2020) paid for rights to use telecommunication service frequencies.

Adjusted net financial debt amounted to 22,164 million euros at September 30, 2021, a decrease of 1,162 million euros compared to December 31, 2020 (23,326 million euros). The reduction brought about by the generation of operating cash, obtained also through the optimization of working capital and the completion of the purchase by KKR Infrastructure of 37.5% of FiberCop from TIM for an equivalent value of 1,759 million euros, has been partially limited by the payments of dividends (354 million euros), the sanction (116 million euros) connected with the Antitrust Case A514 (alleged abuse of a dominant market position on the wholesale access services market and for retail services of the BB and UBB fixed network), substitute tax on the aligned value of assets (231 million euros), and the extension of the rights of use of frequencies on the 2100 MHz bandwidth (240 million euros), as well as the installment on the 5G license (55 million euros).

For a better understanding of the information, the table below shows the various ways by which the Net Financial Debt can be shown:

(million euros) | 9/30/2021 | 12/31/2020 | Change |

|---|

| (a) | (b) | (a-b) |

|---|

Net financial debt carrying amount | 22,492 | 23,714 | (1,222) |

Reversal of fair value measurement of derivatives and related financial liabilities/assets | (328) | (388) | 60 |

Adjusted net financial debt | 22,164 | 23,326 | (1,162) |

Leases | (4,551) | (4,732) | 181 |

Adjusted net financial debt - After Lease | 17,613 | 18,594 | (981) |

Net financial debt carrying amount amounted to 22,492 million euros at September 30, 2021, a decrease of 1,222 million euros compared to December 31, 2020 (23,714 million euros). Reversal of the fair value measurement of derivatives and related financial liabilities/assets recorded a change of 60 million euros compared to December 31, 2020 substantially following the rise in Euro interest rates, which effectively revalue the cash flow hedges. This change is adjusted by the booked Net Financial Debt with no monetary effect.

Adjusted Net Financial Debt – After Lease (net of the impact of all leases), which is a parameter adopted by main European peers, was equal to 17,613 million euros at September 30, 2021, down by 981 million euros compared to December 31, 2020 (18,594 million euros).

During the third quarter of 2021, adjusted net financial debt came to 22,164 million euros, up 92 million euros on June 30, 2021 (22,072 million euros): the positive cash generation deriving from operations has been absorbed by financial operations, the distribution of Daphne 3 reserves (42 million euros) and payment of the installment on the 5G license (55 million euros).

(million euros) | 9/30/2021 | 6/30/2021 | Change |

|---|

| (a) | (b) | (a-b) |

|---|

Net financial debt carrying amount | 22,492 | 22,327 | 165 |

Reversal of fair value measurement of derivatives and related financial liabilities/assets | (328) | (255) | (73) |

Adjusted net financial debt | 22,164 | 22,072 | 92 |

Breakdown as follows: | | | |

Total adjusted gross financial debt | 29,107 | 29,395 | (288) |

Total adjusted financial assets | (6,943) | (7,323) | 380 |

The TIM Group’s available liquidity margin amounted to 9,820 million euros, equal to the sum of:

- “Cash and cash equivalents” and “Current securities other than investments” for a total of 5,820 million euros (5,921 million euros at December 31, 2020), also including 215 million euros in repurchase agreements expiring by March 2022;

- Sustainability-linked Revolving Credit Facility amounting to 4,000 million euros, totally available.

This margin is sufficient to cover Group financial liabilities (current and otherwise) falling due over the next 30 months.

It should be noted that sales without recourse of trade receivables to factoring companies completed during the first nine months of 2021 resulted in a positive effect on the adjusted net financial debt at September 30, 2021, amounting to 1,504 million euros (1,970 million euros at December 31, 2020; 1,585 million euros at September 30, 2020).

RESULTS OF THE BUSINESS UNITS

Domestic

Domestic Business Unit revenues amounted to 9,344 million euros, changing by -128 million euros (-1.4%) compared to the first nine months of 2020. In organic terms, they reduce by 154 million euros (-1.6% on the first nine months of 2020); in particular, revenues for the first nine months of 2020 were affected by non-recurring items for 38 million euros mainly referring to adjustments of revenues connected to TIM S.p.A.’s commercial initiatives to support customers in facing the COVID-19 emergency.

Revenues from stand-alone services come to 8,331 million euros (-282 million euros compared to the first nine months of 2020, -3.3%) and suffer the impact of the competition on the customer base, as well as a reduction in ARPU levels; in organic terms, net of the above-specified non-recurring item, they drop by 303 million euros compared to the first nine months of 2020 (-3.5%).

In detail:

- revenues from stand-alone Fixed market services amounted to 6,385 million euros in organic terms, with a change compared to the first nine months of 2020 of -1.8% mainly due to the decrease in accesses and ARPU levels in the Consumer segment, which is also reflected in the trend of revenues from broadband services (-64 million euros compared to the first nine months of 2020, -3.7%), partly offset by the growth in revenues from ICT solutions (+172 million euros compared to the first nine months of 2020, +23.7%);

- revenues from stand-alone Mobile market services came to 2,361 million euros in organic terms (-182 million euros on the first nine months of 2020, -7.2%), mainly due to ARPU levels and the reduction in the customer base.

Revenues for Handset and Bundle & Handset, including the change in work in progress, are equal, in organic terms, to 1,013 million euros for the first nine months of 2021, with an increase of 149 million euros compared to the first nine months of 2020, for the most part attributable to the Fixed segment.

The performance of the individual market segments of the Domestic Business Unit compared to the first nine months of 2020 was as follows:

- Consumer: the segment consists of all Fixed and Mobile voice and Internet services and products managed and developed for individuals and families and of public telephony; customer care, operating credit support, loyalty and retention activities, sales within its remit, and administrative management of customers; includes the company TIM Retail, which coordinates the activities of flagship stores. In organic terms, net of the aforesaid non-recurring component, the revenues of the Consumer segment totaled 4,156 million euros (-226 million euros, -5.2%) and show a trend, compared to the first nine months of 2020, affected by the challenging competition and greater discipline in commercial processes. The trend seen in total revenues also applied to revenues from stand-alone services, which amounted to 3,577 million euros, changing by -328 million euros compared to the first nine months of 2020 (-8.4%). In particular:

- revenues from Mobile stand-alone services totaled, in organic terms, 1,625 million euros (-140 million euros, -7.9% compared to the first nine months of 2020). The impact of the competitive dynamic remains, albeit with a lesser reduction of the customer base calling; revenues from roaming and incoming traffic are down due to the progressive reduction of interconnection tariffs;

- revenues from Fixed stand-alone services totaled, in organic terms, 1,979 million euros (-185 million euros, -8.6% compared to the first nine months of 2020), primarily due to lower ARPU levels and the smaller Customer Base, which declined gradually during the first nine months of 2021. The growth of Broadband customers is highlighted, in particular Ultra Broadband.

Revenues for Handsets and Bundles & Handsets in the Consumer segment amounted to 578 million euros, +102 million euros compared to the first nine months of 2020 (+21.3%). The increase is mainly due to the sales of the PC program voucher on the fixed amounts and the lesser impact of restrictions for the COVID-19 health emergency as compared with the 2020 lock-down.

- Business: the segment consists of voice, data, and Internet services and products, and ICT solutions managed and developed for small and medium-size enterprises (SMEs), Small Offices/Home Offices (SOHOs), Top customers, the Public Sector, Large Accounts, and Enterprises in the Fixed and Mobile telecommunications markets. The following companies are included: Olivetti, TI Trust Technologies, Telsy and the Noovle Group. In organic terms, net of the aforesaid non-recurring component, revenues for the Business segment amounted to 2,981 million euros (-30 million euros compared to the first nine months of 2020, -1.0%, of which -1.9% for revenues from the stand-alone services component). In particular:

- total Mobile market revenues showed a negative organic performance compared to the first nine months of 2020 (-2.9%), linked to the revenues from stand-alone services component (-6.9%) and the ARPU trend;

- total Fixed revenues in organic terms worsened slightly by 10 million euros compared to the first nine months of 2020 (-0.4%), as did revenues from services component (-0.3%) despite the increase in revenues from ICT services.

- National Wholesale Market: the segment consists of the management and development of the portfolio of regulated and unregulated wholesale services for Fixed-line and Mobile telecommunications operators in the domestic market. The following companies are included: TI San Marino and Telefonia Mobile Sammarinese. The National Wholesale Market segment revenues in the first nine months of 2021, reached 1,484 million euros, up by +88 million euros (+6.3%) compared to the first nine months of 2020, with a positive performance mainly driven by the growth in accesses in the Ultra Broadband segment.

- International Wholesale Market: includes the activities of the Telecom Italia Sparkle group, which operates in the market for international voice, data and Internet services for fixed and mobile telecommunications operators, ISPs/ASPs (Wholesale market) and multinational companies through its own networks in the European, Mediterranean and South American markets. Revenues for the first nine months of 2021 in the International Wholesale Market segment came to 719 million euros, up 15 million euros (+2.1%) on the first nine months of 2020.

EBITDA for the first nine months of 2021 of the Domestic Business Unit amounted to 3,424 million euros (-657 million euros for the first nine months of 2020, -16.1%).

Organic EBITDA, net of the non-recurring component, amounted to 3,913 million euros (-273 million euros compared to the first nine months of 2020, -6.5%), with a margin of 41.9% (-2.2 percentage points compared to the same period of 2020). In particular, EBITDA for the first nine months of 2021 reflected a total impact of -489 million euros referring to non-recurring items, of which -20 million euros related to the COVID-19 emergency in Italy. Moreover, non-recurring expenses include charges connected with corporate reorganization/restructuring processes, provisions for disputes, transactions, regulatory sanctions and potential liabilities and expenses connected with agreements and the development of non-recurring projects.

Organic EBITDA, net of the non-recurring component, is calculated as follows:

(million euros) | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | Changes |

|---|

| | | absolute | % |

|---|

EBITDA | 3,424 | 4,081 | (657) | (16.1) |

Foreign currency financial statements translation effect | — | (2) | 2 | |

Changes in the scope of consolidation | — | (69) | 69 | |

Non-recurring expenses (Income) | 489 | 176 | 313 | |

ORGANIC EBITDA - excluding non-recurring items | 3,913 | 4,186 | (273) | (6.5) |

EBITDA in Q3 2021 was 1,278 million euros, (-119 million euros compared with 2020, -8.5%).

Domestic Business Unit EBIT for the first nine months of 2021 totaled 676 million euros (-636 million euros compared to the first nine months of 2020), with a margin of 7.2% (-6.7 percentage points compared to the first nine months of 2020).

Organic EBIT, net of the non-recurring component, amounted to 1,165 million euros (-250 million euros compared to the first nine months of 2020, -17.7%), with an EBIT margin of 12.5% (14.9% for the first nine months of 2020). Organic EBIT, net of the non-recurring component, is calculated as follows:

(million euros) | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | Changes |

|---|

| | | absolute | % |

|---|

EBIT | 676 | 1,312 | (636) | (48.5) |

Changes in the scope of consolidation | — | (73) | 73 | |

Non-recurring expenses (Income) | 489 | 176 | 313 | |

ORGANIC EBIT - excluding non-recurring items | 1,165 | 1,415 | (250) | (17.7) |

EBIT in Q3 2021 was 363 million euros (-116 million euros compared with 2020, -24.2%).

Headcount stood at 42,811 units (42,925 as of December 31, 2020).

Brazil (average real/euro exchange rate 6.37804)

Revenues for the first nine months of 2021 of the Brazil Business Unit (TIM Brasil group) amounted to 13,259 million reais (12,590 million reais on the first nine months of 2020, +5,3%), speeding up on the levels recorded from the third quarter of 2020.

The acceleration has been driven by service revenues (12,877 million reais vs 12,224 million reais for the first nine months of 2020, +5.3%) with mobile telephony service revenues growing +5.0% on the first nine months of 2020. This performance is mainly related to the continuous recovery of the pre-paid and post-paid segments. Revenues from fixed telephony services have grown by 9.8% on the first nine months of 2020, determined above all by the growth rate of TIM Live.

Revenues from product sales totaled 382 million reais (366 million reais for the first nine months of 2020, +4.4%).

Revenues in Q3 2021 totaled 4,512 million reais, increased by 2.8% on the third quarter of 2020 (4,388 million reais).

The mobile ARPU for the first nine months of 2021 was 25.9 reais, up from the figure recorded in the first nine months of 2020 (24.2 reais) thanks to general repositioning in the post-paid segment and new commercial initiatives intended to promote the use of data and average expenditure per customer.

Total mobile lines in place at September 30, 2021 amounted to 51.6 million, +0.2 million compared to December 31, 2020 (51.4 million). This variation was mainly driven by the post-paid segment (+0.6 million), partially offset by the performance in the pre-paid segment (-0.4 million), in part due to the consolidation underway in the market for second SIM cards. In September 2021, post-paid customers represented 43.4% of the customer base, a percentage point higher than at December 2020 (42.4%).

The TIM Live BroadBand business recorded net positive growth in the first nine months of 2021 in the customer base of 29.8 thousand users, +4.6% compared to December 31, 2020. In addition, the customer base continues to be concentrated on high speed connections, with more than 50% exceeding 100Mbps.

EBITDA in the first nine months of 2021 was 6,232 million reais (5,946 million reais in the first nine months of 2020, +4.8%) and the margin on revenues was 47.0% (47.2% in the first nine months of 2020).

EBITDA in the first nine months of 2021 reflects the non-recurring charges of 21 million reais mainly related to the development of non-recurring projects.

Organic EBITDA, net of the non-recurring component, increased by 5.2% and was calculated as follows:

(million Brazilian reais) | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | Changes |

|---|

| | | absolute | % |

|---|

EBITDA | 6,232 | 5,946 | 286 | 4.8 |

Non-recurring expenses/(income) | 21 | — | 21 | |

ORGANIC EBITDA - excluding non-recurring items | 6,253 | 5,946 | 307 | 5.2 |

The increase of EBITDA is due to the increase in revenue and cost control efficiency.

The relative margin on revenues, in organic terms, comes to 47.2% (47.2% during the first nine months of 2020).

EBITDA for the third quarter of 2021, amounted to 2,146 million reais, up 4.0% compared to the third quarter of 2020 (2,063 million reais).

Net of non-recurring charges, the margin on revenues for the third quarter of 2021 was 47.7% (47.0% in the third quarter of 2020).

EBIT for the first nine months of 2021 amounted to 2,011 million reais (1,827 million reais for the first nine months of 2020, +10.1%).

Organic EBIT, net of the non-recurring component, in the first nine months of 2021 amounted to 2,032 million reais (1,827 million reais in the first nine months of 2020), with a margin on revenues of 15.3% (14.5% in the first nine months of 2020).

Organic EBIT, net of the non-recurring component, is calculated as follows

(million Brazilian reais) | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | Changes |

|---|

| | | absolute | % |

|---|

EBIT | 2,011 | 1,827 | 184 | 10.1 |

Non-recurring expenses/(income) | 21 | — | 21 | |

ORGANIC EBIT - excluding non-recurring items | 2,032 | 1,827 | 205 | 11.2 |

The EBIT of the third quarter of 2021 totaled 755 million reais (683 million reais in the third quarter of 2020).

Net of non-recurring charges, the EBIT margin for the third quarter of 2021 was 16.9% (15.6% in the third quarter of 2020).

In the first nine months of 2021, the spot exchange rate used for the translation into euro of the Brazilian real (expressed in terms of units of local currency per 1 euro) went from 6.37680 at December 31, 2020 to 6.29828 at September 30, 2021. This led, among other things, to an approximate 8 million euro increase in the value of goodwill attributed to the Brazil Cash Generating Unit, expressed in euros.

Personnel totaled 9,366 units posting a reduction of 43 units compared to December 31, 2020 (9,409 units).

AFTER LEASE INDICATORS

TIM Group, in addition to the conventional financial performance measures established by the IFRS, uses certain alternative performance measures in order to present a better understanding of the trend of operations and financial condition. Specifically, following the adoption of IFRS 16, the TIM Group presents the following additional alternative performance measures:

EBITDA ADJUSTED AFTER LEASE - TIM GROUP

(million euros) | 3rd Quarter 2021 | 3rd Quarter 2020 | Changes | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | Changes |

|---|

| | | absolute | % | | | absolute | % |

|---|

ORGANIC EBITDA - excluding non-recurring items | 1,669 | 1,773 | (104) | (5.9) | 4,886 | 5,112 | (226) | (4.4) |

Lease payments | (207) | (192) | (15) | (7.8) | (608) | (577) | (31) | (5.4) |

EBITDA adjusted After Lease (EBITDA-AL) | 1,462 | 1,581 | (119) | (7.6) | 4,278 | 4,535 | (257) | (5.7) |

EBITDA ADJUSTED AFTER LEASE - DOMESTIC

(million euros) | 3rd Quarter 2021 | 3rd Quarter 2020 | Changes | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | Changes |

|---|

| | | absolute | % | | | absolute | % |

|---|

ORGANIC EBITDA - excluding non-recurring items | 1,322 | 1,441 | (119) | (8.3) | 3,913 | 4,186 | (273) | (6.5) |

Lease payments | (126) | (124) | (2) | (1.6) | (381) | (377) | (4) | (1.1) |

EBITDA adjusted After Lease (EBITDA-AL) | 1,196 | 1,317 | (121) | (9.2) | 3,532 | 3,809 | (277) | (7.3) |

EBITDA ADJUSTED AFTER LEASE - BRAZIL

(million euros) | 3rd Quarter 2021 | 3rd Quarter 2020 | Changes | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | Changes |

|---|

| | | absolute | % | | | absolute | % |

|---|

ORGANIC EBITDA - excluding non-recurring items | 348 | 334 | 14 | 4.4 | 980 | 932 | 48 | 5.2 |

Lease payments | (81) | (67) | (14) | (20.9) | (227) | (200) | (27) | (13.5) |

EBITDA adjusted After Lease (EBITDA-AL) | 267 | 267 | — | — | 753 | 732 | 21 | 2.9 |

ADJUSTED NET FINANCIAL DEBT AFTER LEASE - TIM GROUP

(million euros) | 9/30/2021 | 12/31/2020 | Change |

|---|

Adjusted net financial debt | 22,164 | 23,326 | (1,162) |

Leases | (4,551) | (4,732) | 181 |

Adjusted net financial debt - After Lease | 17,613 | 18,594 | (981) |

EQUITY FREE CASH FLOW AFTER LEASE - TIM GROUP

(million euros) | 3rd Quarter 2021 | 3rd Quarter 2020 | Change | 9 months to 9/30/ 2021 | 9 months to 9/30/ 2020 | Change |

|---|

Equity Free Cash Flow | 97 | 688 | (591) | 460 | 1,666 | (1,206) |

Leases | (158) | (226) | 68 | (432) | (673) | 241 |

Equity Free Cash Flow After Lease | (61) | 462 | (523) | 28 | 993 | (965) |

BUSINESS OUTLOOK FOR THE YEAR 2021

2021 guidance updated. The new range reflects startup costs of the new strategic initiatives and market conditions.

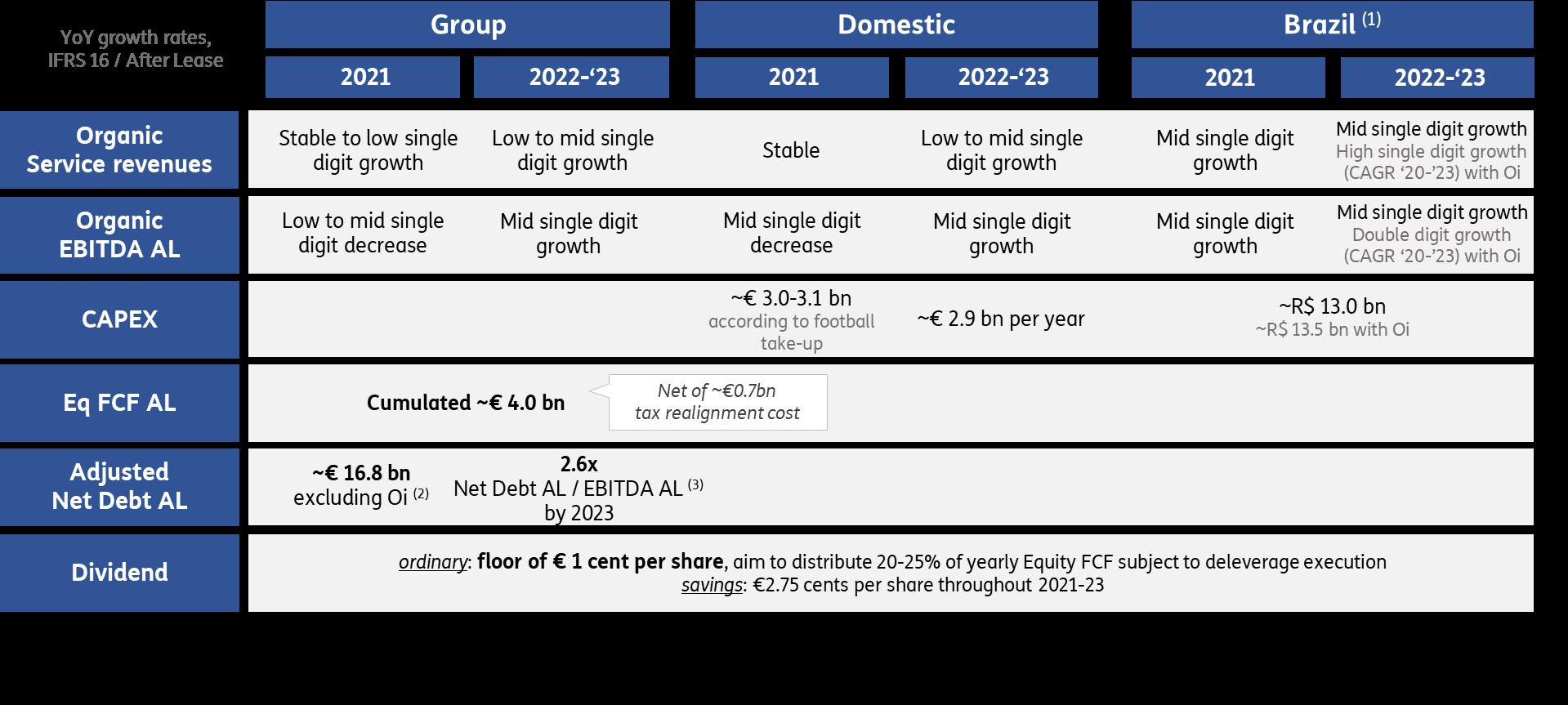

2021-2023 Plan Guidance (July 19, 2021) at the exchange rate 5.9 REAIS/EURO

TIM-DAZN post-agreement, pre-acquisition of part of the mobile business of Oi and National Recovery and Resilience Plan (PNRR), except for the vouchers plan (prior to the PNRR)

2021-2023 Plan Guidance (October 27, 2021) at the exchange rate 6.3 REAIS/EURO

TIM-DAZN post-agreement, pre-acquisition of part of the mobile business of Oi and National Recovery and Resilience Plan (PNRR), except for the vouchers plan (prior to the PNRR)

EVENTS SUBSEQUENT TO SEPTEMBER 30, 2021

No significant events took place after September 30, 2021.

MAIN RISKS AND UNCERTAINTIES

Risk governance is a strategic tool for value creation.

The TIM Group has adopted a Risk Management model that is constantly evolving, aligned with international regulations and standards, to allow the identification, assessment and management of risks in a uniform way within Group companies, highlighting potential synergies between the actors involved in the assessment of the internal control and risk management system.

The Risk Management process is designed to identify potential events that may affect the business, to manage risk within acceptable limits and to provide reasonable assurance regarding the achievement of corporate objectives.

The Risk Management Model adopted by the TIM Group

- classifies risks based on their impact into Strategic (resulting from the evolution of factors underpinning the main assumptions used for the development of the Strategic Plan) and Operational (resulting from the evolution of risk factors, both endogenous and exogenous, which can compromise the achievement of business objectives);

- assesses the risks not just individually but also in terms of the risk portfolio (correlation analyses);

- identifies and updates the overall set of risks to which the Group is exposed through the analysis of the Business Plan, the monitoring of the reference context (macroeconomic, regulatory, etc.), cyclical monitoring with the Risk Owners, in order to intercept any changes and/or new risk scenarios, specific analyses on the risks to which the corporate assets may be exposed.

The business outlook for 2021 could be affected by risks and uncertainties caused by a multitude of factors, the majority of which are beyond the Group's control.

In this context, we highlight the health emergency due to the spread of COVID-19. In addition, non-exhaustively, the following additional factors are mentioned: a change in market context, entry of new potential competitors in the fixed-line and mobile sphere, the initiation of procedures by Authorities and consequent delays in the implementation of new strategies, any constraints connected to the exercise of the Golden Power by the Government with effects – currently not foreseeable – in terms of strategic choices and progress of the already announced three-year objectives which may entail, for some, different timing than that initially scheduled or relative achievement with new and more articulated paths.

Risks related to macro-economic factors

The TIM Group's economic and financial situation depends on the influence of numerous macroeconomic factors such as economic growth, consumer confidence, interest rates and exchange rates in the markets where it operates.

During the second quarter of 2021, Italy recorded a +2.7% increase in the GDP compared with the first quarter of 2021 and +17.3% on the second quarter of 2020 (the worst struck during the health emergency). The easing up of restrictions has improved the faith of businesses and families and the positive contribution to growth comes above all from family spending (+3.7% on the previous quarter). Family consumption has recorded a +5% on the previous quarter, rewarding services (+9.5%) and semi-durable goods (+4.5%), both of which had been penalized by the restrictions. A slight recovery is also seen in purchases of durable (+0.6%) and non-durable (+0.7%) goods, which had been less penalized by the pandemic. Durable goods are the only component of consumptions that have returned to pre-crisis spending levels in Q2 2021. Family consumption look likely to reach pre-crisis levels no earlier than the second half of 2023. Indeed, despite the recovery of available income, consumer trends tend to move forward slowly due to the impact of inflation tension (increased prices in the energy sector).

Exports have grown in volume by 3.4% compared with the previous quarter, exceeding pre-crisis levels ahead of France and Germany, but will only show slow growth during the second half due to the procurement difficulties experienced in some production sectors.

The global context is characterized by a recovery in world trade but the elements characterizing the world economic cycle include risks relating to an increase in the prices of commodities and shipping charters, to the economic sustainability of the recovery strategies to be adopted and to the slowing of production in certain segments impacting the world value chain. For Italy, GDP growth is expected in both 2021 (+6%) and 2022 (+3.8%). These scenarios incorporate the effects of the progressive introduction of the interventions envisaged by the National Recovery and Resilience Plan (PNRR). The effective capacity to implement the measures planned, the control of the pandemic in the autumn-winter season and the completion of the vaccine campaign are the main elements for the social and economic recovery.

The Italian government’s measures to limit the contagion and support household incomes in addition to having had a positive impact on demand, have also led to a severe increase in public debt, which came to 156% of the GDP in 2020, up 21 p.p. on 2019. Forecasts suggest stability of the debt/GDP ratio by year end. In 2021 too, public accounts were impacted by major budget allocations (approximately 100 billion euros) destined to fight the recession effects of the crisis.

The employment market is showing signs of recovery, having returned to pre-crisis levels both through an increase of fixed-term contracts and permanent ones and the simultaneous reduction of use of temporary redundancy systems (CIG). For the Eurozone, current forecasts suggest inflation of 2.2% in 2021 and 1.8% in 2022.

The evolution of the world health care situation linked to the COVID-19 and the completion of the vaccine campaign are essential to the continued national and international social and economic recovery.

In Brazil, after three years of modest growth, the 4.1% decline of the GDP in 2020 was influenced significantly by the COVID-19 pandemic emergency and the restrictions imposed to limit its spread, the lock-downs and social distancing measures that have brought about a general commercial and economic contraction, particularly if compared with the 1.1% growth seen in 2019.

After a devastating first half of 2020, when the pandemic led to the closure of commercial activities, major restrictions in travel and a considerable outflow of capital, which had already begun in 2019, the scenario in the second half of the year changed. The gradual easing of restrictions to travel and social distancing, in a bid to reduce the transmission of COVID-19, and the return to economic activities, coupled with the financial support offered by the government have helped assure a slight recovery in the second half of 2020. 2020 has not recovered the level of activities at end 2019, but the impact was less than initially expected.

During the first half of 2021, with the progress made on the vaccination plan and the gradual reopening of economic businesses, the GDP grew by 1.1% over market expectations. With the first quarter results, the Brazilian GDP returned to the levels of the fourth quarter of 2019, prior to the pandemic, but still 3.1% below the highest value recorded in Q1 2014. Despite the good future prospects, it is not yet possible to predict when Brazil will return to pre-crisis levels.

At the start of the second half of 2021, the threat of a severe energy crisis began entering the Brazilian agenda. However, for TIM Brasil the risk is under control, considering that most of the energy contracts are long-term and will not be impacted by any tariff changes that may be applied. TIM Brasil is also taking steps to reduce structural consumption preventively.

The Executive responsible for preparing the corporate financial reports, Giovanni Ronca, hereby declares, pursuant to subsection 2, Art. 154 bis of Italy’s Consolidated Law on Finance, that the accounting information contained herein corresponds to the company’s documentation, accounting books and records.

Rome, October 27, 2021