BSS Architecture (Usage to Bill)

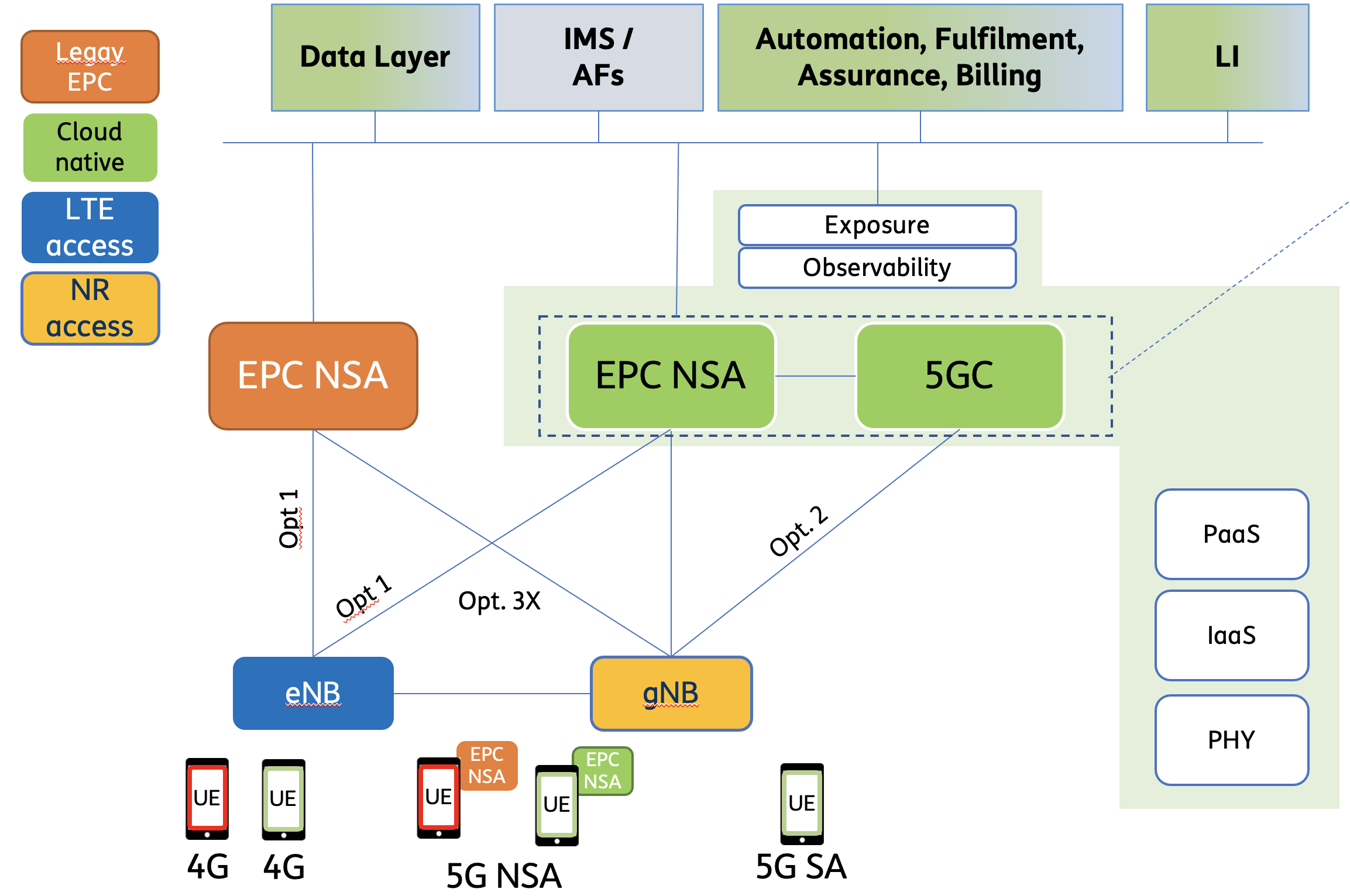

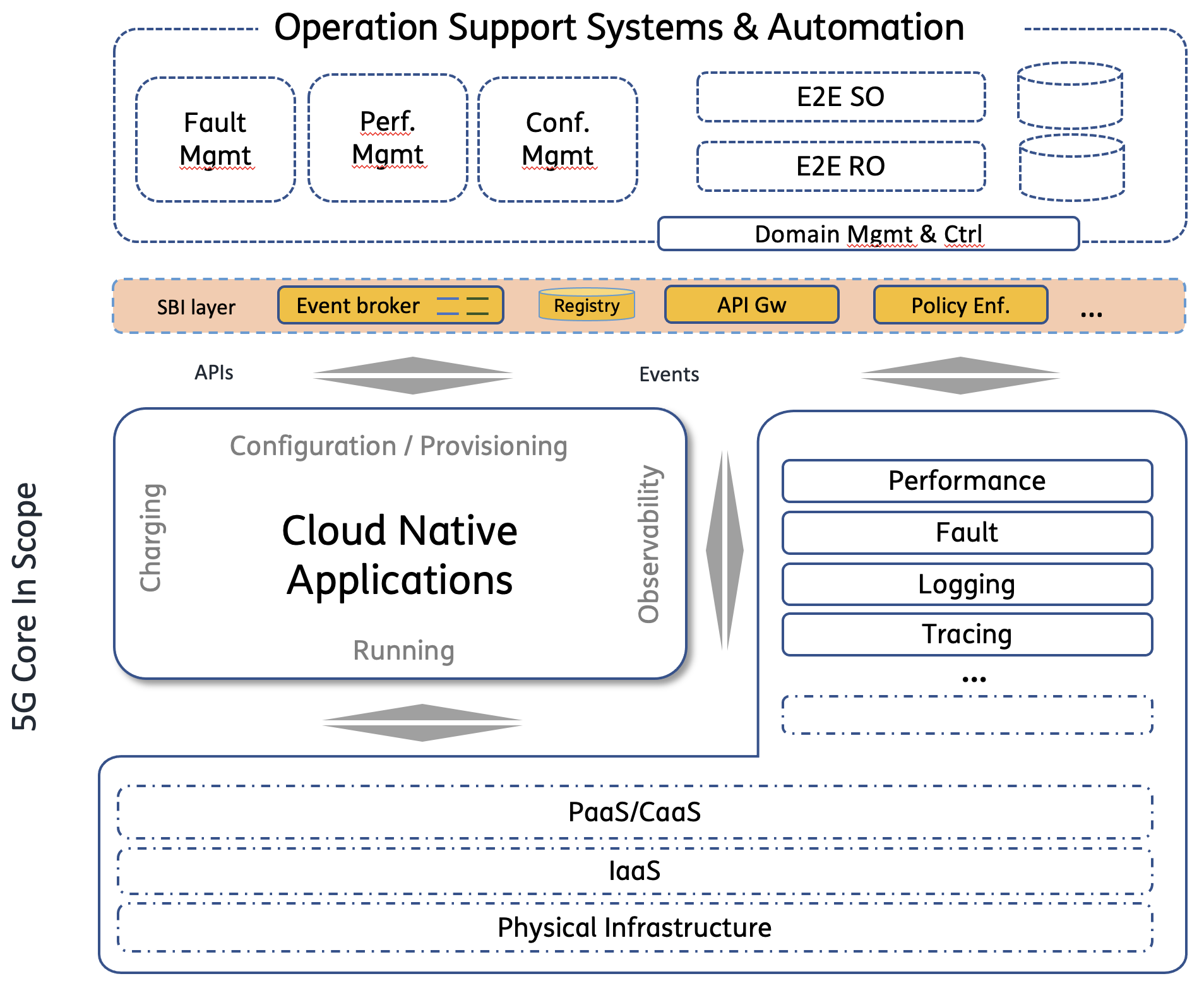

The introduction of the 5G SA core network requires an architectural re-engineering of the online mediation system in the Usage Collection domain and of the Online Charging System in the Billing area. To this end, an architectural evolution roadmap has been defined in the Usage-To-Bill area, aimed at the native integration of the 5G SA core network, enabling the support of new 5G SA offer models and services. In the target architecture the new online mediation component will have to allow integration with both the core 5G network and legacy networks for both prepaid and postpaid mobile customers. The To-Be architecture will enable converged mobile rating, with the ability to extend it to wireline customers, enabling converged native billing. The Charging and Billing capabilities supported by the platforms, deployed on cloud architecture to guarantee performances, scalability and resilience, will be accessible via Open API designed according to the main industry standards.

TIM Brazil Roadmap

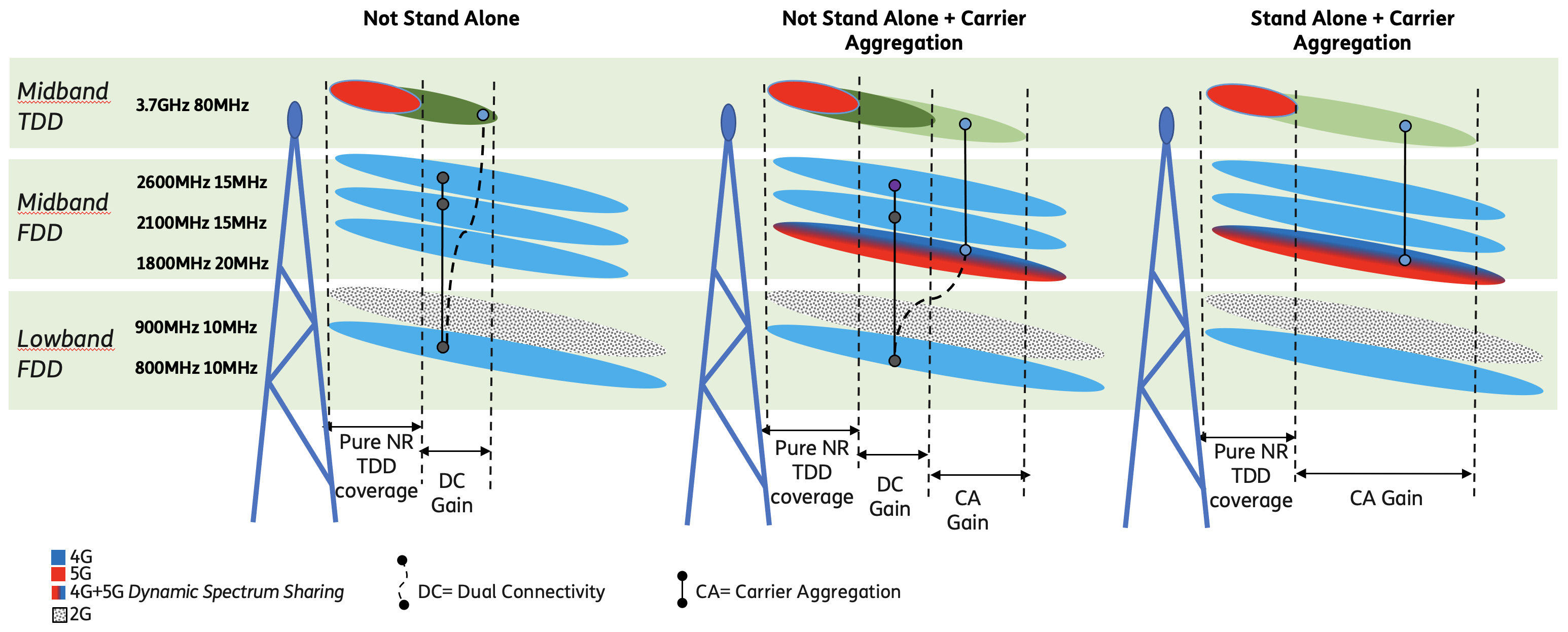

As already mentioned, Anatel included in the 5G auction rules, published in February 2021, a set of obligations among which the requirement that the 3.5GHz frequencies should be used in 5G StandAlone Release 16 or higher and specific coverage obligations in 3.5GHz. This means that Brazilian operators are not allowed to rely on DSS technology to fulfill 5G coverage obligations, meaning that 5G SA networks must be deployed on 3.5GHz.

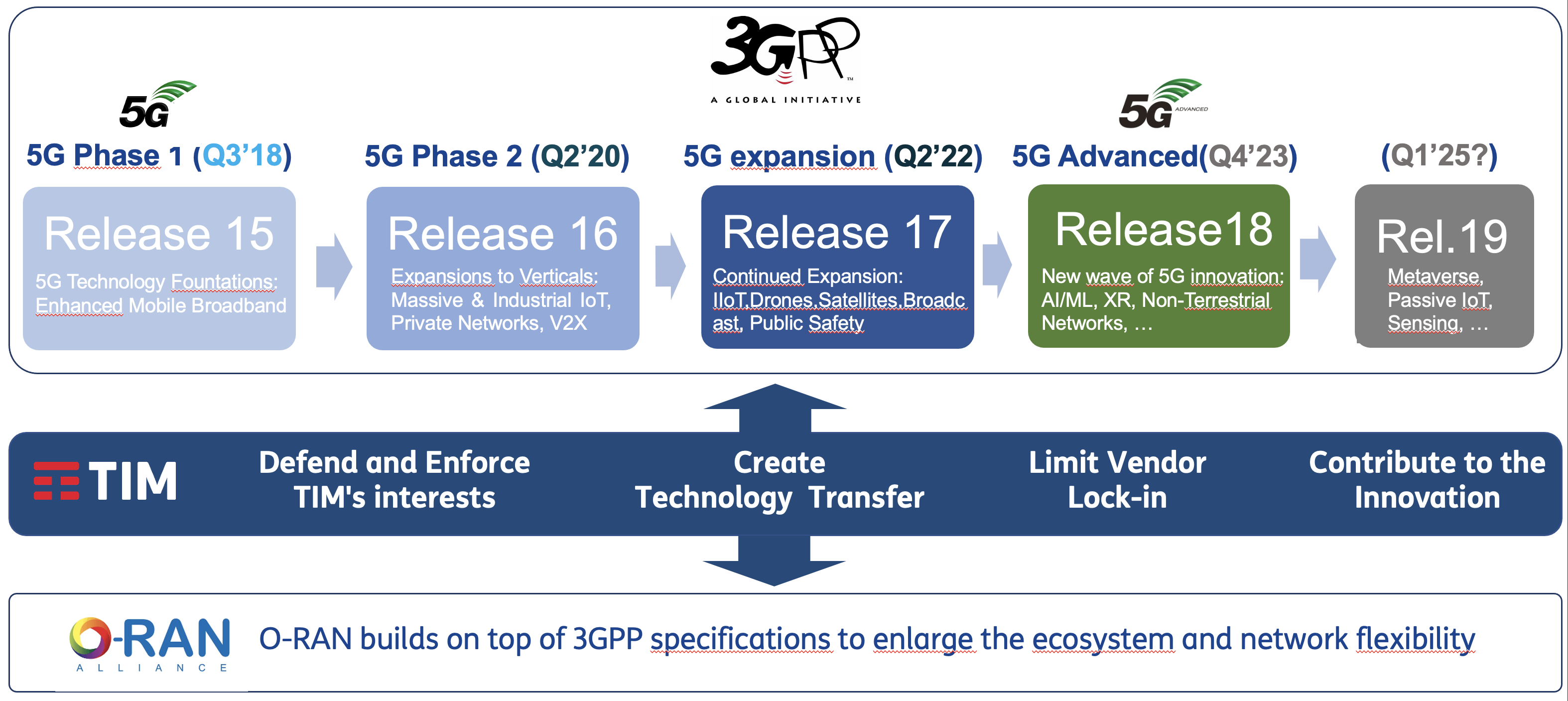

Anatel stated that 5G SA will be available in the capitals of all 27 states of Brazil by July 2022. This will be the first 5G coverage obligation to be fulfilled by the winning bidders. The target architecture for 5G SA is a fully 4G/5G Convergent infrastructure, contemplating all the network functions specified by 3GPP for the 5G Core, as well as the evolutions foreseen for the RAN layers and with a high degree of automation, orchestration, and programmability. Having as initial base the functionalities specified by 3GPP in Release 16, TIM Brazil will follow the evolutions foreseen for the subsequent releases, aiming, in particular, to ensure the use of the new functionalities to support the new applications and monetization opportunities brought by the eMBB, URLLC and mMTC dimensions. The access layer infrastructure will evolve gradually to explore also O-RAN solutions, establishing a hybrid environment, combining O-RAN with traditional RAN architectures and the coverage will be expanded based on, mainly, the 3.5 GHz and 26 GHz, and later, the 2.3GHz that will, initially, be used for the LTE Network.

New services such as mMTC and URLLC will be added as the Network and Transmission grid evolves and reduction on latency is inherent to the 5G SA technology. Another highly probable new service will be the Private Networks, that had an evolutionary leapfrog with the launch of the 5G Network, Network Slicing and Edge Computing. The coming challenge will be the layer management, as LTE traffic will continue growing until 2025 and refarming from 4G to 5G will gradually be done. Providing the best possible experience to the subscribers will be the key, regardless of the type of terminal they use. NR brings new antenna configurations that shall be applied to the different coverage scenarios as MIMO 32x32 and 64x64 for outdoor or 8x8, mainly for indoor use. Voice Services (VoNR), Network slices and Exposure will be supported and an E2E automation framework for operation, dynamic network slices implementations, allowing to explore new business models and the fully potential that new functions like NWDAF and NEF can offer. In BSS environment, the service-based architecture for charging and billing systems for 5G SA and the corresponding functions and interfaces that support this new architecture will need to evolve significantly and will be service based interfaces (SBI). There will be a convergent billing interface covering online charging, automatic charging, and data recording.

As part of 5G SA evolution support some of IT BSS ongoing and in planning initiatives are listed below:

- 5G CHF – 5G Charging function implementation;

- 5G CCS – Convergent Charging System;

- MIoT – Massive Internet of Things platform;

- Network Exposure Function (NEF) Northbound APIs/Open Telco API Management.